written by Guest Contributor, Theodore Kucklick and Tiger Buford

“Why can’t I get funding for my innovative orthopedic startup?”

I hear this complaint from leaders of early innovative startups. What is going on here?

First, let’s look at the Big 5.

The Big 5 Orthos, commonly referred to as the “strategics”, have mountains of cash. Their biggest asset is their distribution channels. So, you would think that they would look for ways to feed their distribution channel with new products, increase their top line and keep the shareholders happy. After all, we all know that new products open doors to compete with entrenched competitors. New products give the sales person a reason to go back and see the surgeon who is loyal to the competition. New products bring positive attention to the company.

The Big 5 have chosen not to innovate from within, so they have to buy innovation. Their management does not incentivize employees to work on new technology. It’s cheaper in their minds to pay more for a later, de-risked deal. The finance people running these companies seem to avoid R&D expenses that ding earnings and share value. A company turning over EBITDA will have numerous private equity opportunities. The problem with the Bigs investing in smaller companies are the rendition costs, especially upgrading a quality system in a small lean operation to the level a major has to operate. This quality and regulatory bar will get higher with the new CE Mark rules over the next two years.

If you understand what the majors are looking for, then you can reverse-engineer that back into an opportunity they will find attractive. They are your “strategic acquirer customer” who will give you liquidity. You have to understand this “”strategic acquirer customer” perspective just as well as you understand your clinical customer. You have to know their needs, be able to build to those needs, and have a trust relationship.

Perfect! Sounds good.

So why don’t the Big 5 simply buy technology innovation startups?

Problem #1 – The Big 5 do NOT buy TECHNOLOGY

At the Canaccord meeting ahead of AAOS this year, the Big 5 spelled out exactly what they were shopping for – sales. They readily admit that they are not looking to acquire technology, but to acquire new customers. “Bring us $8M or more of revenues and we may be interested.”

Here is the dilemma For a cash-strapped innovation startup to reach $8M, they have to spend more than 50% of their capital on sales & marketing, not product. These days, even for $8M in sales, it takes a real sales presence to penetrate the Integrated Health Networks (IHN). For a innovative technology startup, building a sales channel can consume more capital and incur more dilution than you realize.

Problem #2 – The Big 5 do NOT buy RISK

They have become so risk averse, that they are only interested in startups that have adequately retired the technology risk, retired the regulatory risk, retired the reimbursement risk, and have proven sales. In other words, the startup has enough real customers who are paying handsomely for the new innovative product.

What about the VCs?

Well, as a general rule today, the VCs are only funding investments that fit into their profile and they are generally looking at later stage startups. Also, VCs are not your friend and you must be very careful in partnering with them.

My favorite quote about VCs rings true… “VCs are like hitchhikers with credit cards. They get in your car, and as long as you take them where they want to go, they will help pay for the gas. But if you get lost or wander off the road you promised you were going down, they will hijack the car, throw you out and bring in a new driver.” John Mackey, Founder of Whole Foods.

Now we are down to the Angels.

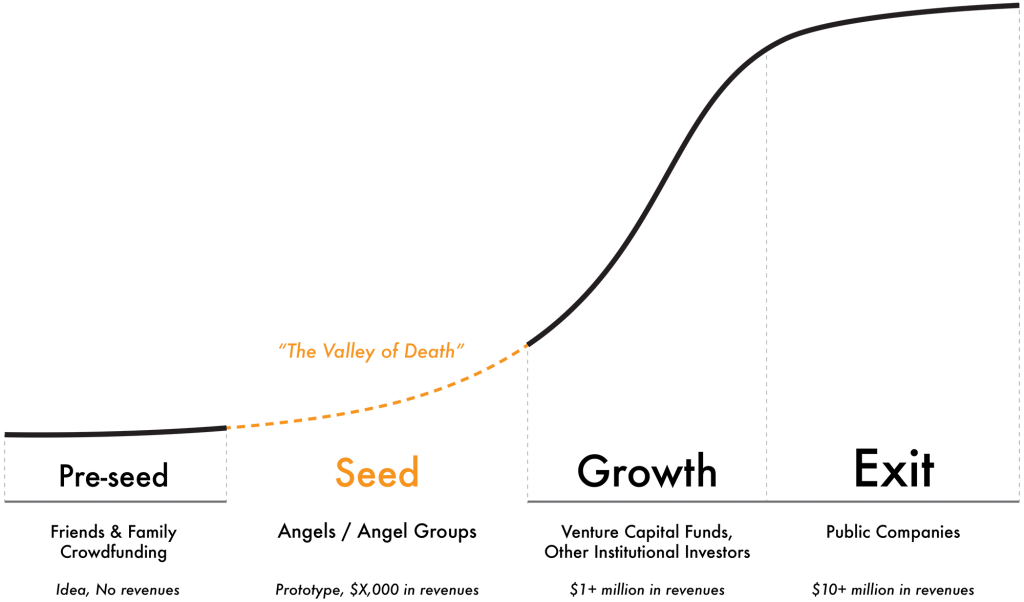

The Angels are a good fit for you. Today, the Angels are really the only ones funding early innovation, but there just are not enough Angels to fill the need. And there is a huge gap between the seed stage capital and growth stage capital. This gap has been referred to as the “Valley of Death” because so many startups do not survive this valley.

A new positive trend in early stage capital is the syndicated Angel deal. Orthopedic startups are hitting angel groups that have multiple chapters, or are syndicating across multiple Angel groups to piece together the the sort of capital raises that the smaller VCs (now extinct) used to do. These Angels are now the most active early stage investors, but they cannot fund everyone.

So, we can see that there are funding challenges with the Bigs, the VCs and the Angels.

The end result is that there is scarce funding for truly innovative startups in orthopedics today.

So what is an orthopedic startup with a great idea to do?