Alphatec raises $50m, acquires SafeOp Surgical (MassDevice)

Alphatec (NSDQ:ATEC) had a busy day yesterday. The spinal implant maker revealed that it paid $27 million in cash and stock to acquire SafeOp Surgical and its intraoperative neuromonitoring technology, raised $50 million to cover the tab and made a raft of personnel changes – including the installation of former NuVasive Inc. (NSDQ:NUVA) exec Pat Miles as CEO. Oh, and it reported fourth-quarter and full-year results that beat the consensus forecast on Wall Street.

Carlsbad, Calif.-based Alphatec paid $15 million up front plus 3.3 million ATEC shares, worth $11.5 million at yesterday’s $3.48-per-share closing price. The deal also involves a $3 million convertible note and warrants for 2.2 million shares at an exercise price of $3.50 apiece. Another 1.3 million ATEC shares are on table as performance milestones, Alphatec said.

“This strategic acquisition of SafeOp marks a transformational moment for the new ATEC,” Miles said in prepared remarks. “Our answer to the need for better neuromonitoring is investing in technology that automates information to enable objective clinical decision making and eradicate non-critical operating room personnel. The integration of this key technology into our spine procedures will address unmet clinical needs and improve surgical outcomes in spine. We expect the combination to accelerate our business by increasing procedural revenue and driving pull-through across our entire portfolio.”

Alphatec said it plans to cover the cash portion of the SafeOp deal with the $50 million it raised in a private placement deal, a warrants issue and a $4.8 million warrant exchange with an existing investor.

L-5 Healthcare Partners led the private placement, joined by some Alphatec executives and directors and new and existing institutional backers. The remaining $35 million is earmarked for general corporate purposes, the company said.

Personnel moves already the subject of lawsuits

As part of Miles’s move to the corner office, Alphatec shifted Rich down the hall the to president & COO office. The company also named a spine surgeon as its chief medical officer and tapped a trio of SafeOp and NuVasive veterans for executive roles.

The new CMO is Dr. Luiz Pimenta, a well-known spine surgeon with 30 years of clinical practice behind him. Former SafeOp CMO & development VP Dr. Richard O’Brien and Robert Snow, that company’s ex-marketing VP, are also taking executive roles at Alphatec. And Jim Gharib, another NuVasive veteran who was technical lead for its neurophysiology platform, hired on to lead the SafeOp development and integration, Alphatec said.

The hiring of Miles prompted a lawsuit from his former employer alleging that he schemed to secretly back Alphatec while discouraging NuVasive’s pursuit. Alphatec counter-sued in October 2017; NuVasive last month leveled poaching and patent infringement claims against Alphatec in California federal court.

Q4, 2017 results beat The Street

Alphatec swung to black for the fourth quarter despite a -3.0% top-line slide, posting profits of $9.1 million, or 53¢ per share, on sales of $26.3 million for the three months ended Dec. 31, 2017. That compares with losses of $-4.4 million during Q4 2016. Analysts were looking for losses of -25¢ on sales of $23.3 million for the quarter.

Full-year losses were down -92.3% to -$2.3 million, or -18¢ per share, on sales of $101.7 million. That’s a -15.4% decline compared with 2016, but still ahead of the $99.6 million consensus on The Street, where the bottom-line expectation was for losses of -$1.16 per share.

“We closed 2017 with solid momentum, and on excellent footing to continue to drive ATEC’s advancement into an innovative, growth organization,” Rich said in prepared remarks. “Throughout the year, we demonstrated great progress with the transition of our sales channel and aggressively managed expenses and cash. We have an exceptionally strong understanding of what it will take to achieve our vision and the strongest team in spine to accomplish it.”

Alphatec said it expects to report sales of roughly $95.0 million this year.

“As the transition of our distribution channel progresses, top-line visibility will continue to be somewhat limited as we discontinue non-strategic relationships and navigate the contracting process to execute each transition. However, I am proud to say that we are beginning to see our efforts reach fruition. As 2018 progresses, we expect that sales from the dedicated portion of our channel will continue to offset the negative revenue impacts associated with transitioning or discontinuing non-strategic distributor relationships,” Rich said.

ATEC shares closed up 2.4% at $3.48 apiece yesterday. The stock opened down -0.6% to $3.46 today.

PRESS RELEASE

Alphatec Spine Disrupts Market with Acquisition of SafeOp Surgical, ~$50M Equity Financing, and Strategic Leadership Appointments (press release)

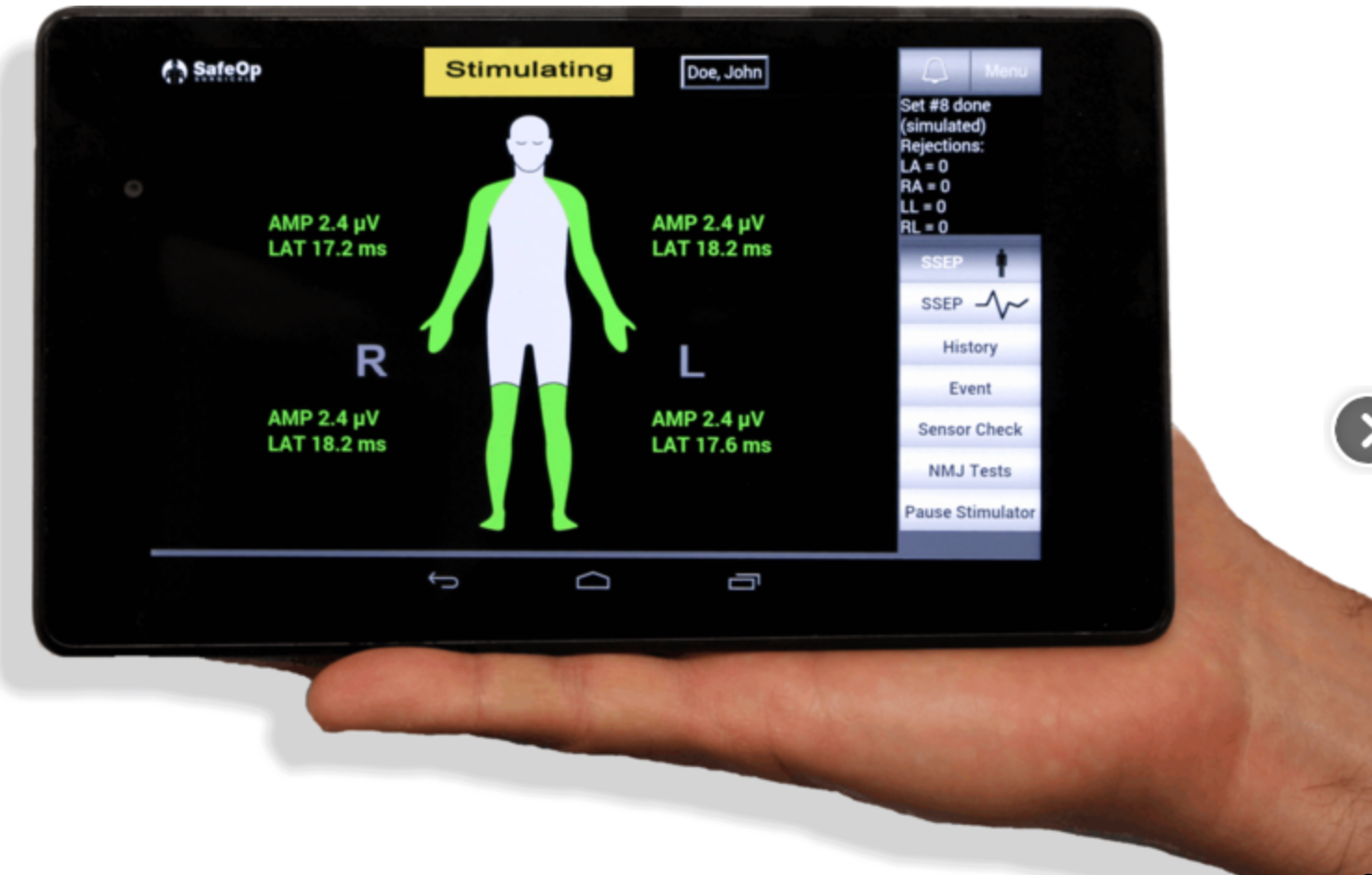

Alphatec Holdings, Inc. (“Alphatec” or the “Company”) (Nasdaq:ATEC), a provider of innovative spine surgery solutions with a mission to improve patient lives through the relentless pursuit of superior outcomes, announced today that it has acquired SafeOp Surgical, Inc. (“SafeOp”). SafeOp is a privately-held provider of advanced neuromonitoring technology designed to prevent the intraoperative risk of nerve injury with automated assessment that obviates the need for a technician or other neuromonitoring professional in most surgeries. The Company also announced a $50 million capital raise, the proceeds of which were used, in part, to fund the acquisition.

Additionally, the Company announced several leadership updates. Pat Miles has assumed the role of Chief Executive Officer. Terry Rich has been appointed President and Chief Operating Officer. Both will retain their existing Board positions. Dr. Luiz Pimenta has been appointed Chief Medical Officer.

SafeOp Acquisition

SafeOp has developed patented technology that automates SSEP’s (Somatosensory Evoked Potentials), designed to provide surgeons with unprecedented, objective feedback during surgery.

“This strategic acquisition of SafeOp marks a transformational moment for the new ATEC,” said Pat Miles. “Our answer to the need for better neuromonitoring is investing in technology that automates information to enable objective clinical decision making and eradicate non-critical operating room personnel. The integration of this key technology into our spine procedures will address unmet clinical needs and improve surgical outcomes in spine. We expect the combination to accelerate our business by increasing procedural revenue and driving pull-through across our entire portfolio.”

In consideration for SafeOp, Alphatec will pay $15 million in up-front cash, a $3 million convertible note, and the issuance of 3.3 million shares of common stock and warrants to purchase 2.2 million shares of common stock at an exercise price of $3.50 per share. SafeOp will be eligible to receive an additional 1.3 million shares of common stock, subject to the achievement of performance milestones. The issuance of the shares of common stock in the merger, including at closing, upon achievement of milestones, conversion of the notes and exercise of the warrants is subject to limitations until required stockholder approval is obtained in accordance with the NASDAQ Global Select Market rules.

Leadership and Board Appointments

The Company also announced the following leadership and board appointments.

Dr. Luiz Pimenta will advise Alphatec as Chief Medical Officer. Pimenta is a world-renowned spine surgeon with over 30 years of expertise, and is widely credited with pioneering innovative surgical techniques and developing new technologies to improve spine surgery. His broad contributions have been commercialized via numerous industry partners. Dr. Pimenta will enhance the ATEC strategy by focusing on spine innovation and medical education.

Miles continued, “I am honored and thrilled to work again with Dr. Pimenta. His decision to assume a key role in our mission is pivotal. It speaks volumes of the surgical community’s perception of ATEC’s visceral dedication to improved outcomes through eXtreme innovation.”

Richard O’Brien, M.D., and Robert Snow, the scientific principals of SafeOp, with over 50 years of combined neurophysiology expertise will join Alphatec as executives. Prior to serving as Vice President of Development and Chief Medical Officer of SafeOp, Dr. O’Brien, a renowned inventor and neurologist, was Medical Director of Impulse Monitoring, Inc., a neuromonitoring provider. Before joining Impulse Monitoring, O’Brien spent over two decades in the neurophysiology field, as both a physician and consultant. Mr. Snow, a neurophysiologist, was SafeOp’s Vice President, Marketing for 5 years, following an 11-year tenure as co-founder and Senior Vice President of Marketing at Impulse Monitoring.

“I could not be more excited to join the ATEC family and to engage in the creation of automated tools that provide objective information for better clinical decision making,” said O’Brien.

The SafeOp development and integration effort will be led by Jim Gharib, an electrical engineer with more than 20 years of experience in the field of neurophysiology. Gharib was the technical lead of NuVasive’s neurophysiology platform from the company’s inception to its achievement of billion-dollar revenue levels. Gharib is a named inventor on more than 20 patents in the fields of neuromonitoring, spine surgery, IV infusion, and blood chemistry.

“I am exceptionally pleased to work again with Rob, Richard, and Jim, the new leaders of our adjunctive technology team,” said Terry Rich, President and Chief Operating Officer of Alphatec. “They each have a proven history of successfully creating value in the neurophysiologic and spine marketplace. I look forward to working with each of these new leaders as we evolve into a leading spine market player.”

Three new members have joined the Alphatec Board of Directors, in connection with the above transactions:

- James Tullis, the founder and Chief Executive Officer of Tullis Health Investors, a healthcare investment firm, has over 40 years of experience in healthcare-focused investments. Prior to establishing his firm in 1986, Tullis served as an award-winning healthcare investment research analyst and Principal at Morgan Stanley, focusing on pharmaceuticals and medical devices.

- Jason Hochberg a partner with L-5 Healthcare Partners, and the Founder and CEO of SJS Beacon, an investment company, has over 20 years of business and legal experience. Prior to founding SJS Beacon, Hochberg held various leadership roles throughout a 15-year tenure at LS Power, an energy investment and innovation company, serving most recently as Chief Operating Officer and as a Principal in LS Power’s private equity fund advisor. He started his professional career at the law firm of Latham & Watkins in 1996.

- Evan Bakst, a partner with L-5 Healthcare Partners, and the Founder of and Portfolio Manager at Treetop Capital, a healthcare investment firm. He has over 25 years of experience in healthcare-focused investments. Prior to founding Treetop Capital, Bakst was a partner for 7 years at Tremblant Capital, an equity hedge-fund manager, where he led the global healthcare group and held various other leadership roles.

Equity Financing Transactions

The Company announced that it has entered into financing transactions to raise an aggregate of $50 million, through a private placement of Series B Convertible Preferred Stock and warrants exercisable for common stock, and a warrant exchange agreement with a holder of an existing warrant for an aggregate consideration of $4.8 million. The private placement was led by L-5 Healthcare Partners, LLC, a healthcare-dedicated institutional investor, and included certain directors and executive officers of Alphatec, as well as other new and existing institutional and independent investors. The Company used a portion of the net proceeds from the private placement and warrant exercise to fund the $15 million cash purchase price for SafeOp, and expects to use the remainder for general corporate purposes.

Raymond James & Associates, Inc., is acting as placement agent in connection with the private placement and financing advisor in connection with the SafeOp acquisition.

Additional information and legal disclosures about the transaction are contained in the Company’s Current Report on Form 8-K to be filed with the Securities and Exchange Commission.

The securities to be sold in the private placement will not have been registered under the Securities Act of 1933, as amended, or state securities laws as of the time of issuance and may not be offered or sold in the United States absent registration with the Securities and Exchange Commission (SEC) or an applicable exemption from such registration requirements. Alphatec has agreed to file one or more registration statements with the SEC registering the resale of the shares of common stock purchased in the private placement and the shares of common stock underlying the warrants and issuable upon conversion of the Series B Convertible Preferred Stock.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful.

Inducement Award

As an inducement to accepting employment with the Company, and in accordance with applicable NASDAQ listing requirements, the Board of Directors has also approved an award, collectively, to these new additions of 45,000 restricted stock units (RSUs) and 45,000 stock options (Options).

The RSUs and options will be granted following registration of the common stock underlying the RSUs and Options. The RSUs will vest in equal annual installments on each of the first four anniversaries of date of employment, and the options will vest 25 percent on the first anniversary and in equal monthly installments of 1/36th of the balance of the Options, provided the recipient remains continuously employed by Alphatec as of such vesting date. In addition, the RSUs and Options will fully vest upon a change in control of Alphatec.

The Board approved an amendment to Alphatec’s 2016 Employment Inducement Award Plan to increase the shares reserved for issuance thereunder by 600,000 shares, effective March 6, 2018.

Investor Conference Call

Alphatec will hold a conference today at 1:30 p.m. PT / 4:30 p.m. ET to discuss the strategic acquisition, in conjunction with fourth quarter and full year 2017 results. The dial-in numbers are (877) 556-5251 for domestic callers and (720) 545-0036 for international callers. The conference ID number is 7887979. A live webcast of the conference call will be available online from the investor relations page of the Company’s corporate website at www.atecspine.com.

About Alphatec Holdings, Inc.

Alphatec Holdings, Inc., through its wholly owned subsidiary Alphatec Spine, Inc., is a medical device company that designs, develops, and markets spinal fusion technology products and solutions for the treatment of spinal disorders associated with disease and degeneration, congenital deformities, and trauma. The Company’s mission is to improve lives by providing innovative spine surgery solutions through the relentless pursuit of superior outcomes. The Company markets its products in the U.S. via independent sales agents and a direct sales force.

Additional information can be found at www.atecspine.com.

About Safe-Op Surgical

SafeOp is a privately-held provider of automated neuromonitoring technology. The Company’s EPAD device was approved by the FDA in January 2014, intended for use in monitoring neurological status by automating & recording somatosensory evoked potentials (SSEP) or assessing the neuromuscular junction (NMJ). Functionality, including free run EMG and triggered EMG will be added later this year.